Online payments

Right now, it feels like the whole world is shopping online, and there’s never been a better time for your business to join in. With Tyl by NatWest, you can accept online payments through your website, via a secure link if you’re not online, or over the phone on a device such as a laptop, tablet or desktop computer. Just sit back, relax, and take secure online payments with a minimum of fuss.

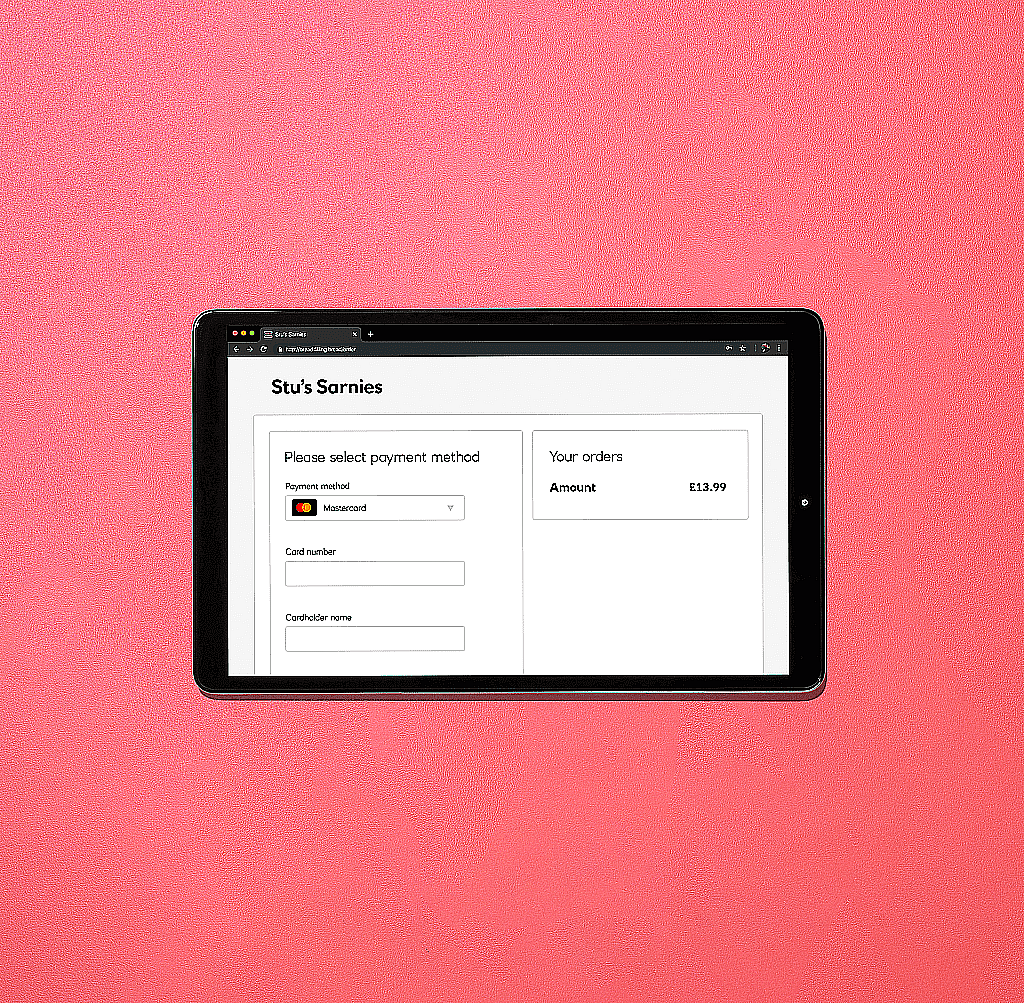

Accepting online card payments has never been easier

What do I get with online payments?

At Tyl, we love online transactions just as much as the over-the-counter ones. Our online payments facility allows you to grow your business from anywhere, on any secure smartphone, tablet or computer.

Accept payments through your website or via a handy link if you don’t have a site. Prefer talking? You can take payments over the phone via your internet browser. However you do business, there’s no difference in the pricing between face-to-face or remote sales.

It’s all taken care of by Tyl, all under one simple monthly fee no matter how many transactions you do.

£14.95+VAT per month*

12 months no monthly fees^

*Price is for online payment services only. PCI DSS (Payment Card Industry Data Security Standard) and processing costs will also be charged (details in quote). To include a card reader service ask us for a personal quote.

^Offer available for new and existing Tyl by NatWest customers who do not currently have a payment gateway with Tyl. Offer ends 30 June 2024. We’ll be in touch to let you know your options after 12 months (previously priced at £14.95+VAT per month on a monthly subscription basis). The Payment gateway comprises of online, telephone and pay-by-link payment functionality. Tyl eligibility criteria, terms and conditions and fees apply.

NatWest Tap to Pay

Take card payments with your iPhone and Android phone.

We make it easy to get your business online

What to expect from our secure payment pages

FAQs about online payments

How do I take payments online?

With Tyl, you can take online payments on a website in two easy ways:

Pay by link

You can use our virtual terminal to create a link that you email over to your customer (or you can text them, IM them, or send them a QR code, etc). When they click the link, it’ll take them to a secure payment page where they can enter their card details and complete the payment.

Pay by link is super helpful in scenarios where you’d usually get paid after you’d already delivered the goods or service, such as with an invoice (and nothing needs to be posted). It’s also more secure than taking phone payments.

We’ve created a detailed user guide to help explain exactly what you can do.

Hosted payment pages

We can also help you add hosted payment pages to your website, so you can accept payments online. We’ll take the customer’s card data and redirect the payment to their bank so they can authenticate it using 3D secure. Also, as hosted payment pages technically belong to us, you won’t need to worry as much about complying with the Data Security Standard of the Payment Card Industry (PCI DSS).

To help you through the integration process we’ve created a handy hosted payment pages guide.

Are online payments safe?

With Tyl, you can take payments securely online whether you’re using hosted payments pages or our virtual terminal. Taking payments in these ways helps keep your cardholder data safe and minimises your PCI exposure.

When you take payments on our hosted pages or using pay by link, you also get the added benefit of 3D Secure authentication, which helps reduce fraud and reduce your liability for chargebacks.

3DS2 is a way to make card payments more secure. Tyl is already compliant, meeting the government’s new PSD2 regulations, so you’re good to go.

What is required for using payment gateway on my website?

Here’s what you’ll need displayed prominently on your website (or dummy site) if you want to use our payment gateway:

- card scheme logos at the point of sale

- legal compliance compliant with any known legal restrictions or regulations

- a description of the goods or services you offer

- your delivery and refund/ return policies

- details of how to contact your customer services department

- details of which currencies you accept transactions in and any export restrictions (if applicable)

- your consumer data privacy policy

- your terms and conditions.

We’ll ask for your website address (your URL) when you’re submitting your application.

If we can’t see everything in the list above on your website when you’re applying, we might get in touch with you to request details about what goods or services you sell, who owns the stock, where the stock is held and how long it takes for your business to provide the goods and services it offers.

How do I access my e-commerce portal?

You’ll need to log in using the store ID and password, which will be different for each environment. Here are the links to both:

It’s a good idea to make sure the live payment data is only processed via the production account. The authorisation results in the test account are simulated, so the money won’t be sent to you.

What is the difference between online payments and phone payments?

An ‘online’ as opposed to ‘phone’ payment simply refers to the means by which your customers contact you to place an order. They may buy your products or services through your website – known as an online payment – or they may call you on the phone. Whether you’re speaking to a customer on the phone, or have received an order on your laptop or tablet, you can process the online virtual payment using the Tyl virtual terminal.

What can I do in the virtual terminal?

You can:

- Take payments over the phone or generate payment links

- See all your sales data and reports

- Use our anti-fraud tools

- Accept or decline if you’re using pre-authorisation

- Process refunds (full or partial)

- Create and manage users

- Customise the look and feel of your hosted payment pages